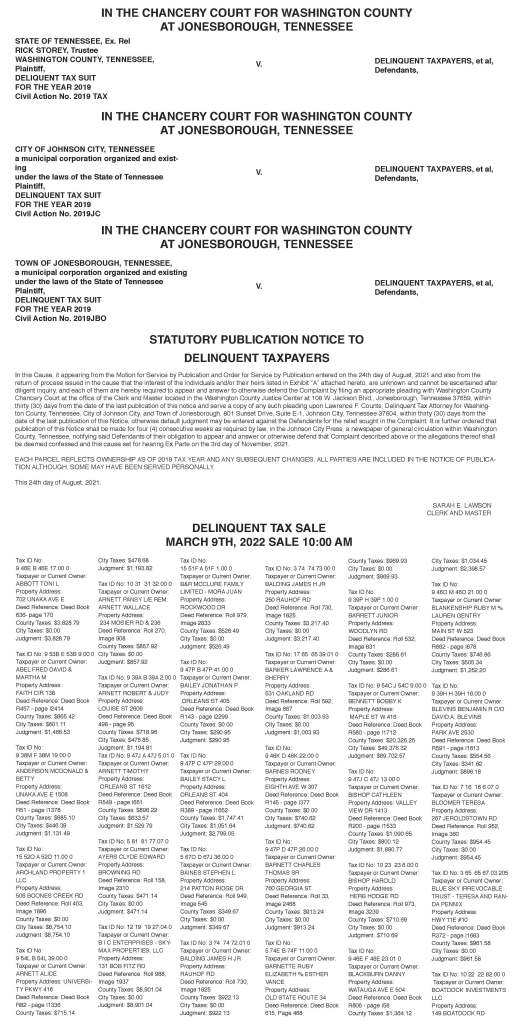

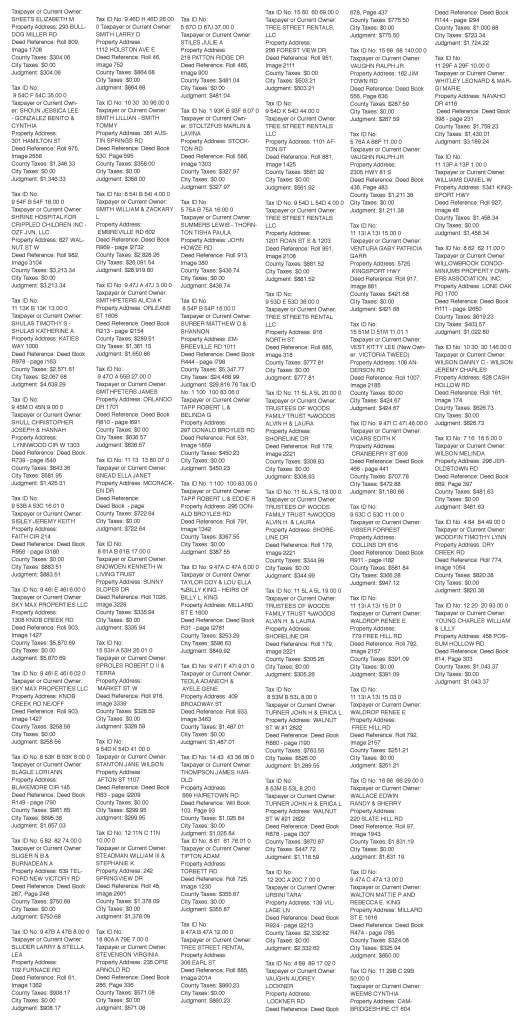

You can view “Tax List.pdf” at:

https://acrobat.adobe.com/link/track?uri=urn:aaid:scds:US:6b0a9852-c545-393b-95d9-49df81f86e44

Serving the people of Washington County, Tennessee

You can view “Tax List.pdf” at:

https://acrobat.adobe.com/link/track?uri=urn:aaid:scds:US:6b0a9852-c545-393b-95d9-49df81f86e44

You can view “Updated Tax List.pdf” at:

https://acrobat.adobe.com/link/track?uri=urn:aaid:scds:US:4e0012d2-d9b8-38ac-9d5c-4c34aebff0a7

We are working hard to verify bidders. Please do not call to let us know you are “pending approval” as we are constantly checking on new registration and working to get bidders approved. Thank you for your patience.

Also, the list will be updated tomorrow at noon and 5:00 p.m. We anticipate a high volume of people coming in to pay taxes. There are currently 67 parcels remaining for sale.

Please note the photos shown on WWW.GOVEASE.COM, on the auction screen, may not reflect the actual state of the real property. The images are not current. It is recommended that bidders view the property prior to bidding.

Bidders are reminded that they are responsible for completing a title examination and checking on the status of the real property. Further, bidders should check with municipal and county codes enforcement to determine if any action is scheduled on the purchased property.

Sign up to bid at www.govease.com

Cedar Point Lane, Johnson City

Sale will be at the Justice Center, 108 West Jackson Blvd. Jonesborough, TN

Registration begins 9:40 am. Sale to begin at 10:00 am

10% due at close of sale

Registration will begin at 9:40 a.m. at the George P. Jaynes Justice Center. You can print and fill out the form below. After the form is filled out you may email to slawson@washingtoncountytn.org Or fax to 423-788-1536

You may also bring the form with you on the day of sale. Registration forms will be available day of sale. See post below for more information.

List of Liens Not Included in Minimum Bid

NOTICES TO BIDDERS & PURCHASERS AT DELINQUENT TAX SALE

The goal of the delinquent tax sale is to sell the properties to satisfy the delinquent tax amount including court costs, attorney’s fees and publication costs, etc. There are many inherent risks in a tax sale therefore the notices herein are aimed at minimalizing any risk of a sale being set aside and, more importantly, avoiding litigation.

THE CONTENT HEREIN IS PROVIDED ONLY AS A COURTESY AND DOES NOT CONSTITUTE LEGAL ADVICE AND MAY NOT BE RELIED ON AS SUCH. NOR IS IT A FULL INTERPRETATION OF THE STATUTES. IF YOU HAVE SPECIFIC QUESTIONS ABOUT ANY LAW, YOU SHOULD CONSULT THE TENNESSEE CODE ANNOTATED OR CONSULT AN ATTORNEY.

SEARCHES MADE IN COMPLIANCE WITH THE STATUTE ARE FOR THE USE OF THE DELINQUENT TAX ATTORNEY AND CLERK & MASTER ONLY; THEY ARE NOT MADE FOR THE BENEFIT OF POTENTIAL TAX SALE BIDDERS AND ARE NOT TO BE RELIED UPON BY POTENTIAL TAX SALE BIDDERS.

9.5 acre wooded lot for sale! February 5, 2022 at 10:00 a.m. This property will be auctioned at the front of the George P. Jaynes Justice Center at 10:00 a.m.

Early registration will be available on this website beginning February 2, 2022. Registration will be available on the day of sale beginning at 9:40 a.m.

LAND SALE NOTICE

In obedience to Judgments/Orders of the Chancery Court at Jonesborough, Tennessee, in the above-styled cause, I will on Saturday the 5th day of February 2022, beginning at 10:00 a.m., at the FRONT OF THE GEORGE P. JAYNES JUSTICE CENTER, 108 W. Jackson Blvd., Jonesborough, Tennessee, SELL that property described below on a credit of not less than six (6) month, nor more than 2 years, and upon confirmation by the court, without the right of redemption or equity of redemption, with all faults, not subject to raised bids and subject to the Judgments/Orders entered in the above captioned cause, to the best and highest bidder, the real property interest described herein, filed in the above referenced cause, and located in the 8th Civil District of Washington County, Tennessee. For more information please see http://www.washingtoncountycourtsales.com

Pursuant to the orders of the Chancery Court for Washington County, at least and specifically the ORDER, filed November 10, 2021, and entered in Minute Book 360, Page 979. Sarah Lawson is ordered to sell, as Clerk and Master, the real property, described as follows:

BEGINNING at a stone in an old county road; thence North 62 degrees East 306 feet to a sourwood tree and corner to Raymond Taylor; thence North 22 degrees 30 minutes West 690 feet to a stake along a branch; thence along said branch South 40 degrees West 389 feet to a small locust tree; thence South 69 degrees West 390 feet to a red oak; thence North 41 degrees West 45 feet to a red oak; thence South 54 degrees 30 minutes West 62 feet to a stake; thence South 15 degrees 30 minutes East 92 feet to a stake; thence South 59 degrees West 88 feet to a stake in the Rambo line; thence with Rambo’s line South 30 degrees East 154 feet to a stake, corner to Boyd and Rambo; thence with Boyd’s line South 83 degrees 30 minutes East 660 feet to the point of BEGINNING, containing nine and one-half acres, more or less.

BEING part of the same property conveyed from Wayne Coombs and Meredith Kuhn, to Wayne Coombs and Meredith Kuhn, as joint tenants with a right of survivorship, by deed dated the 23rd day of June, 2020, recorded in the Register’s Office for Washington County, Tennessee on Roll 1020, Image 2004. See also those two deeds recorded on Roll 993, Image 748; and on Roll 874, Image 2042, to which reference is here made.

This conveyance is made expressly subject to all covenants, conditions, restrictions and reservations contained in former deeds and other instruments of record applicable to said property insofar as same are presently binding thereon and to any easements apparent from an inspection of the property.

TERMS OF SALE

Sale of real property will be made 10% down day of sale with the remainder paid on or before thirty (30) days from the date of sale.

Any judgment liens against the property shall be paid from the proceeds of the sale and may affect the reserve price on the day of sale.

PROPERTY WILL BE SOLD “AS IS” WITH NO WARRANTIES, AND WITH NO REPRESENTATION BEING MADE AS TO THE STATE OF THE TITLE OR THE ACCURACY OF THE LEGAL DESCRIPTION OF THE REAL PROPERTY, AS WELL AS SOLD SUBJECT TO ANY LEASEHOLD INTEREST(S) AND/OR ANY OTHER AGREEMENT(S). A letter of credit is required to pay by personal check. Said property will also be sold subject to all rights-of-way and easements, applicable building/zoning regulations, any restrictive covenants, as well as any defects including structural defects and/or contamination, if any, which may exist. The Clerk & Master has undertaken NO inspections, examination, or cleanup of the subject property.

Announcements made day of sale take precedence.

SALE IS/ARE SUBJECT TO THE CONFIRMATION OF THE CHANCERY COURT.

Sarah Lawson, J.D., Clerk & Master

George P. Jaynes Justice Center; second level

108 W Jackson Blvd., Suite 2157, Jonesborough, TN 37659

Current as of August 20, 2021

EDIT- Please note this is the complete list of delinquent properties