This tax list will be updated daily, and can be found at www.govease.com.

CLICK HERE for Tax list as of 2/2/26

Registration closes on March 2, 2026. No new registrations will be accepted on the day before the sale. Please make certain your address information is consistent across all registration documents, and your bank letter must be in the name of the person registering for the sale. See further terms below.

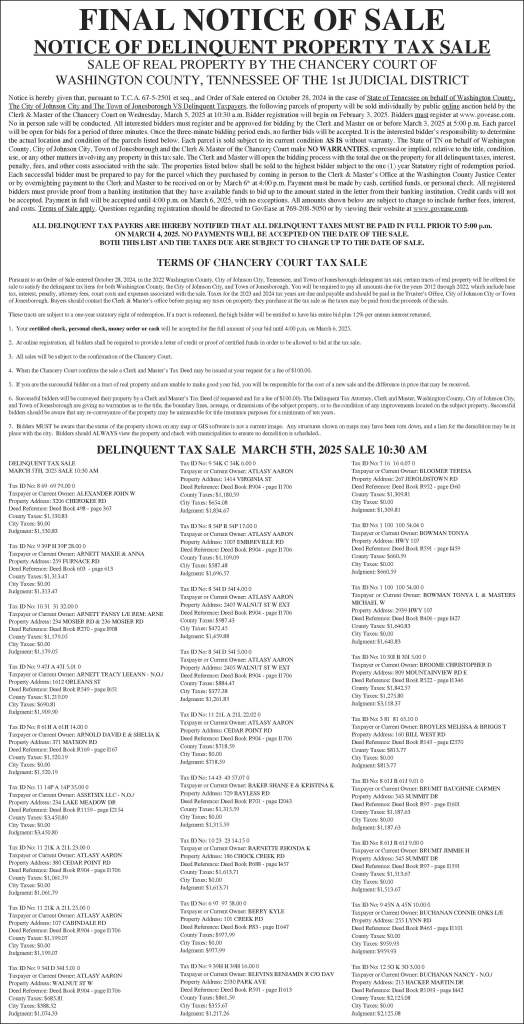

TERMS OF CHANCERY COURT TAX SALE

Pursuant to an Order of Sale entered October 28, 2025, in the 2023 Washington County, City of Johnson City, Tennessee, and Town of Jonesborough delinquent tax suit, certain tracts of real property will be offered for sale to satisfy the delinquent tax liens for both Washington County, the City of Johnson City, and Town of Jonesborough. You will be required to pay all amounts due for the years 2013 through 2023, which include base tax, interest, penalty, attorney fees, court costs and expenses associated with the sale. Taxes for the 2024 and 2025 tax years are due and payable and should be paid in the Trustee’s Office, City of Johnson City or Town of Jonesborough. Buyers should contact the Clerk & Master’s office before paying any taxes on property they purchase at the tax sale as the taxes may be paid from the proceeds of the sale.

These tracts are subject to a one-year statutory right of redemption. If a tract is redeemed, the high bidder will be entitled to have his entire bid plus 12% per annum interest returned.

1. Your certified check, personal check, money order or cash will be accepted for the full amount of your bid until 4:00 p.m. on March 5, 2026.

2. At online registration, all bidders shall be required to provide a letter of credit or proof of certified funds in order to be allowed to bid at the tax sale.

3. All sales will be subject to the confirmation of the Chancery Court.

4. When the Chancery Court confirms the sale a Clerk and Master’s Tax Deed may be issued at your request for a fee of $100.00.

5. If you are the successful bidder on a tract of real property and are unable to make good your bid, you will be responsible for the cost of a new sale and the difference in price that may be received.

6. Successful bidders will be conveyed their property by a Clerk and Master’s Tax Deed (if requested and for a fee of $100.00). The Delinquent Tax Attorney, Clerk and Master, Washington County, City of Johnson City, and Town of Jonesborough are giving no warranties as to the title, the boundary lines, acreage, or dimensions of the subject property, or to the condition of any improvements located on the subject property. Successful bidders should be aware that any re-conveyance of the property may be uninsurable for title insurance purposes for a minimum of ten years. 7. Bidders MUST be aware that the status of the property shown on any map or GIS software is not a current image. Any structures shown on maps may have been torn down, and a lien for the demolition may be in place with the city. Bidders should ALWAYS view the property and check with municipalities to ensure no demolition is scheduled